$VLN.TO: updated thoughts

I really like the story, it's only gotten better but the stock has weakened

Felt like sharing some incremental thoughts on Velan, especially after the stock’s recent weakness that allowed me to add 30% more shares to my position which now sits as my #2 position and not far from #1.

I am very surprised by the price action on Velan, I understand the market struggles mentally to get past $13 since that was the Flowserve offer, but we live in a completely different world, there’s been a tectonic shift in the outlook for nuclear over the past 2 years.

I got two main points to share.

1 - The nuclear story is playing out beautifully and Velan is unbelievably cheap for the best way to play nuclear

Since I wrote the initial post, the story on nuclear has kept getting better and better.

For the US market the big one has been Trump.

I believe his election turbocharges the potential of nuclear in the US. While it’s already a bi-partisan topic, Trump’s goal with his new admin is to de-regulate and grow the US economy through greater productivity.

If you listen to interviews of Scott Bessent, the incoming US Treasury Secretary, his plan is for growth through productivity, and for the US to become the global powerhouse energy, likely through both LNG, nuclear and combined cycle natural gas (all end markets Velan is in).

In November, the US issued official goals to massively expand its nuclear capacity, the acting secretary of the DoE’s Office of Nuclear Energy said the DoE aims to add roughly 60x more nuclear power in the next 25 years than has been built in the last 25 years. (https://www.theatlantic.com/technology/archive/2024/12/america-nuclear-power-revival/680842/)

This focus of the US to grow the economy, de-regulate and become the global powerhouse for electricity/power generation is a game changer for Velan.

On the 3rd of December Meta also announced having submitted proposals to deliver 1-4GW of nuclear capacity starting in 2030, a huge move showing they’re willing to take on some development risk to build power, a wild outcome for a tech company.

Beyond the US here’s some more anecdotal news:

GE Vernova announced seeing demand for up to 57 SMRs (BWRX-300) across its target markets by 2035 which would require 3-4 reactors a year.

Vietnam voted to resume construction of 2 nuclear power plants after an 8 year pause, and announced plans for more new large and small reactors.

Saskpower in Canada plans to build 2 GE BWRX 300 reactors to replace coal power generation.

The Ford government in Ontario (Canada) announced their goal to add 16GW of new power generation in Ontario with likely the great majority of it being Canadian nuclear like Bruce Power and Pickering.

Alberta is proposing the construction of 2 SMR units for $3.6Bn.

Netherlands is doing feasibility studies from 3 vendors to build 2 nuclear reactors (1.6GW) in country, up from only 480MW of installed capacity today.

France announced plans for 0 interest loans to finance the construction of 6 new nuclear reactors.

And what’s been more and more topical is the decline of Europe as an industrial power because of their decision to phase out Nuclear and rely on imported Russian gas. There’s definitely a much greater push ex Germany in Europe to fix this, starting with the great nuclear power that France is.

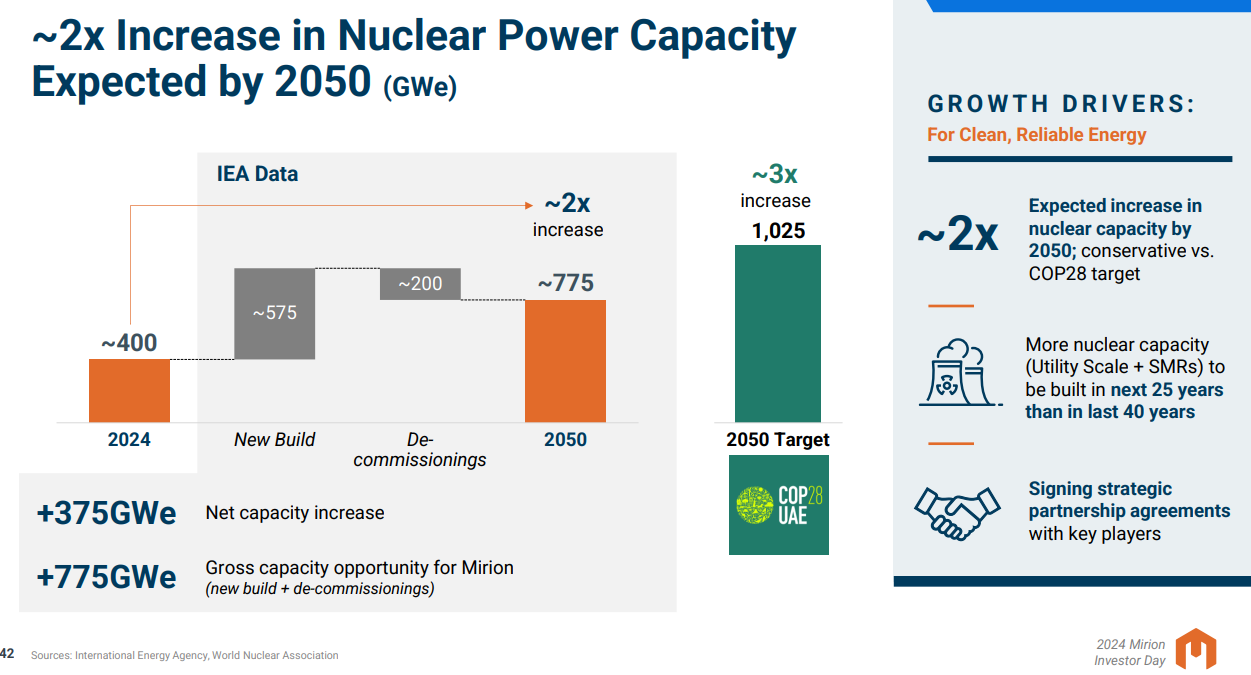

Also an interesting slide from Mirion’s Investor Day:

Now what interests people, Velan has traded sideways while the group has traded way up, likely because it’s still very under the radar. Any company tied to nuclear has now gotten a massive re-rating to multiples way beyond Velan.

The funniest of them all to me is Flowserve who tried to acquire Velan at 130% premium 2 years ago, who saw its stock go up 37% since September, with its most recent earnings call having 26 mentions of nuclear and all Flowserve wanted to talk about given the momentum, despite it being only 8% of revenue. Man it’s too bad they didn’t get Velan the first time!

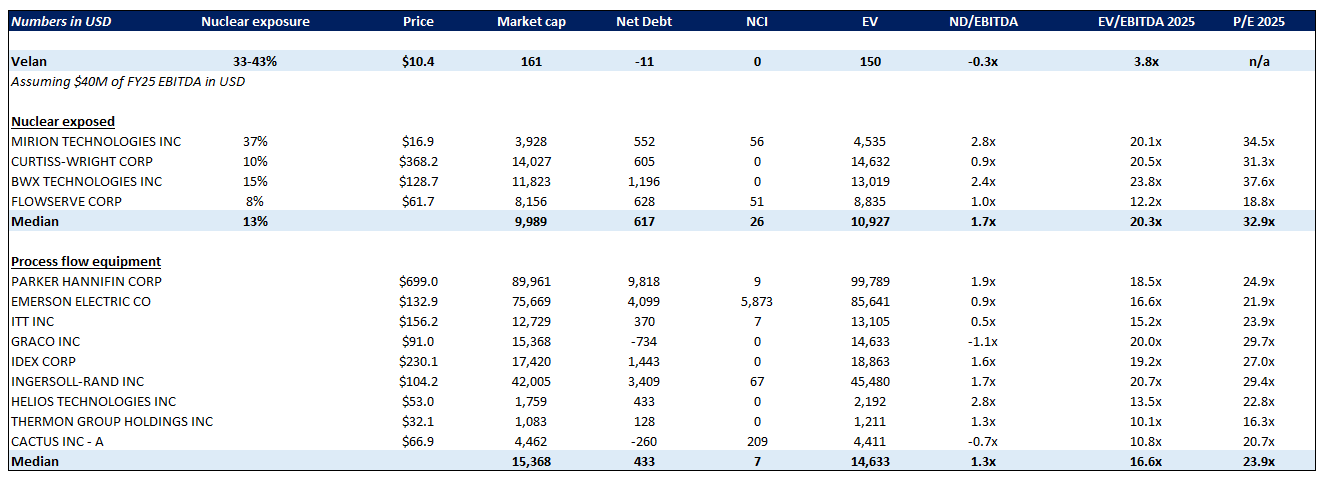

Below is a comp sheet I made that includes nuclear exposed industrial companies like Velan to showcase the massive multiple difference between the two, despite Velan having the most exposure.

I also added below some other process flow equipment companies that operate in other end markets outside nuclear where Velan also has exposure like refining, midstream, LNG, Defense, pulp & paper, etc.

Velan sits sub 4x EBITDA when the nuclear group is at 20x and process flow equipment group at 17x.

I am not arguing that Velan is as good of a business as the companies on this list, I am just arguing the disconnect is the craziest I have ever seen. It also gives you an idea of what strategics can pay.

It’s also worth noting that VLN has more margin expansion room than all these companies.

Basically, Velan’s dirt cheap, and everyone on this list and beyond this list probably dreams of acquiring Velan so they can get some of this nuclear momentum that a chosen few have experienced.

2 - What’s up with the non-nuclear end markets?

We don’t quite know precisely the size of each Velan end market but we have a list, so I’ll go one by one and give my assessment of things.

Power generation: supply over 2,000 thermal power stations for both natural gas and coal. To get a sense on how strong the outlook for baseload power is, especially combined cycle natural gas, you just have to look at how the stocks tied to capex spending are doing.

GE Vernova and Argan have been absolute miracle stocks with GEV up 185% since being spun off in March, and Argan up 200% YTD.

The same drivers behind nuclear apply to natural gas and coal, we need more baseload power.O&G and petrochemicals: valves and steam traps for oil refineries, petrochemical plants, hydrogen plants and coker units.

This has a more tepid outlook, or at least had, but since the Trump election, every stock tied to O&G and petrochemical capex has done very well, justifiably, since his admin is likely to stop delaying permits for new projects, and maybe even bring back subsidies.

Thermon and Flowserve have most of their businesses tied to this, and since the announcement of the Trump win, Thermon is up 25% and Flowserve up 10%.

The message they’ve put out is that a lot of projects that made financial sense in the O&G/petrochem space haven’t been greenlit because of a non-supportive administration, this likely changes.Defense: Velan supplies valves to US Navy nuclear submarines and aircraft carriers like the Virginia class and the Columbia class. The outlook here is really strong and there’s a ton of demand, the US is trying to get ready for potential tensions in the China sea and is aggressively in need of nuclear subs, especially the Columbia class. The real issue here has been the ability of shipyards to deliver on time, but overall demand is strong. BWXT has significant exposure to these and is doing quite well.

LNG: cryogenic valves. This ties back to the US’ plan to become an energy powerhouse, and the very positive Trump election. We’re likely to see a ton more LNG projects come out and get greenlit because the economics make sense. GTLS is a good proxy for the market’s view on the end market, and the stock is doing very well.

Water & wastewater: instead of talking just take a look at this chart, things are very good: https://fred.stlouisfed.org/series/TLWSCONS

Other end markets: in there is pulp & paper which I don’t really have a view on, probably flat, mining which has a strong outlook in North America given precious metal prices and the outlook for battery metals locally, and carbon neutral technologies which is probably too small to matter.

So while I keep talking about nuclear, the rest of Velan’s end markets are actually in really good shape and big beneficiaries of the recent Trump election.

All that to say, I like the stock, I bought more, this is not investment advice, this is for yours, and my, entertainment only.

It is odd, I thought tariff fears might be a reason for the sell off but Canadian industrials ETF ZIN.TO is +15% last 3 months. Seems like a good spot to add.

Yes. I have increased my position too!