I am getting lazier by the day on write-ups so this will be as short as I can make it.

I believe Velan is a triple threat, it’s got the nuclear cycle behind it, a big margin opportunity and take-out potential.

For some background in how I was looking for nuclear exposure as I quite liked the theme, found Velan in mid September and bought my initial position then in the mid $6s. I then doubled my position Friday the 11th of October when they reported Q2 2025 results, I was willing to pay up to $10.5 and got filled at $8.9 so thank you to whomever decided to sell the stock up 1% to me.

After buying my initial position in the stock, I found

’s write up of Velan. I highly recommend reading his substack post on Velan (see below), and as far as a company overview, I won’t do much of one and recommend reading his instead which is quite comprehensive.Company overview and history

Velan was founded by an Eastern European immigrant named AK Velan who left his home country around WW2 and founded Velan in 1950.

Velan makes valves, very difficult to make, highly engineered valves. They’ve been doing it for multiple decades, and have become the default in all of their applications. It’s fundamentally a very sound business, they’re in 90% of nuclear reactors worldwide and 90% of North American refineries.

Here’s the different end markets they participate in:

Nuclear: have an installed base of 380 reactors worldwide with 50 years of experience in the sector working on all the core types of reactors (AP1000, CANDU, etc.) and when they become a reality, on SMRs. That's 380/440 nuclear reactors worldwide so 86% market share.

Power generation: have supplied over 2,000 thermal power stations for low and high pressure/temperatures which can be natural gas, coal or nuclear.

Oil & Gas/chemicals: since the 1950s they've been supplying lots of different valves and steam traps, their valves are in 90% of North America's oil refineries. Their products are used in oil refineries, petrochemical refineries, hydrogen, for LNG terminals and for coker units.

They also do valves for polyethylene, vinyl chloride, monomers, catalysts, etc.LNG and cryogenics: cryogenic valve product line for LNG, particle accelerators, and aerospace reaching extremely low temperatures.

Pulp and paper: are in most pulp and paper mills in North America and throughout the world.

Mining: used for all kinds of applications like for slurry, slag, tailings, gas, water, and feed lines.

Shipbuilding & Defense: have supplied valves to more than 950 US Navy and NATO ships (US Navy has 480 active ships in total) and all US Navy nuclear submarines and nuclear aircraft carriers.

Water & wastewater: for water infrastructure.

Carbon neutral technologies: they sell specific valves to reduce fugitive emissions.

Revenue by geography: 34% US, 25% France, 19% Canada, 13% Italy, 9% other.

Velan doesn’t disclose their end market mix precisely, but if you do a bit of reverse engineering, look back in old filings and some more math, the business is about 1/3 nuclear, 1/3 MRO/aftermarket, 1/3 the rest (O&G, LNG, water…).

The majority shareholders of Velan today remain the family, it’s been family run for years, but more recently there’s been a couple outsider CEOs, and less and less kids involved in day to day business activities.

The business has been ok over the years, definitely under-performing vs what it could do given the family involvement, but they also faced a very significant headwind in Fukushima which crippled the nuclear market and put their largest exposure in shrink mode.

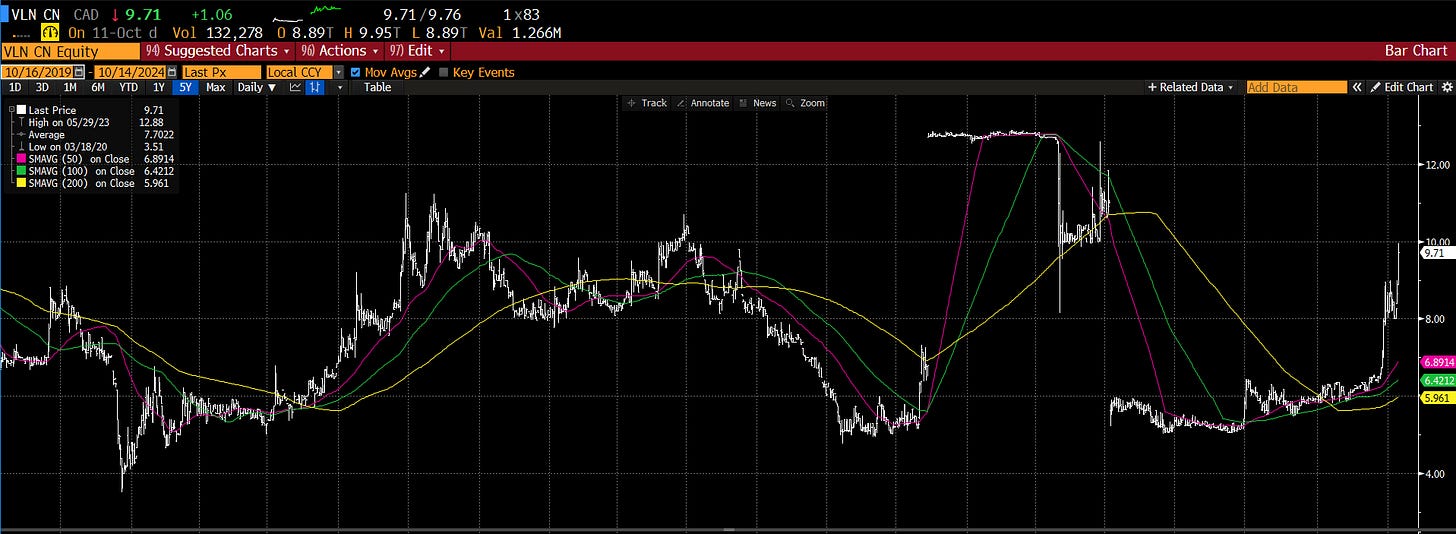

So why does the 5 year chart look like this?

In February 2023, the company initiated a strategic review to sell itself, the family wanted the money, they were less involved today than historically, and decided it was the right time.

I think the results even surprised the family. According to their filings, there were 101 potential bidders, 65 NDAs signed, and 11 initial offers.

Flowserve ended up bidding $13 per share, a humongous 135% premium from the launch of the strat review.

All is good, everyone’s rich and Flowserve is happy with one of the most badass valve companies in the world which they didn’t pay much for and will be able to squeeze a ton of margins with grown up oversight.

But then, drama strikes. France’s Minister of the Economy, Bruno le Maire, blocks the deal after it received the approval of Canada and the United States. The reasoning wasn’t very well developed, but something along the lines of national security since the valves Velan manufactures in France go into French nuclear reactors, nuclear submarines and nuclear aircraft carriers.

The real reason is likely a bit different, Flowserve wasn’t well liked by the French government, especially the running party (LREM), because in 2016 during an election year they fired an entire facility’s worth of employees in France, which were all unionized.

Stock then trades way down back to pre-deal. Insiders start buying.

Once the deal is fully cancelled, Velan changes CEO. The Chairman of the Board (first non family Chairman) James Mannenbach is made interim CEO in October of 2023, and formally becomes CEO in February 2024.

He seems to be pretty legit, he’s an American industrial executives who’s spent years at very legit companies including running Emerson’s Process Flow business (competitor of Velan, much larger), Industrial Technology at Roper, and ran a couple of PE backed companies.

Stock then starts to lift nicely as results start to look better and better, with stronger management in place, and improving bookings growth.

Quick overview of the latest quarter, Q2-2025

Revenue $99M, +23% YoY

Includes $5.2M of 0 gross profit revenue that was a cancelled order from a Russian EPC, artificially lowers gross margins

Adj. EBITDA $5.1M, +56% YoY

5.5% margin ex 0 GP order

CFFO $10M (vs -$21M a year ago)

Bookings $117M, +63% YoY

Book to bill 1.2x (at a seasonally low book to bill quarter)

Backlog $548M

$396M of which to be de-livered in the next 12 months

Expect continued momentum in H2

Seeing strength in nuclear, defense and O&G

Expect to benefit from the US nuclear reactor re-starts

“Stock has started to work but not satisfied yet, working for all shareholders”

Threat 1: Velan is one of the (very) rare ways to play the nuclear cycle

I am very bullish nuclear, some are, some aren’t.

I could write a dissertation on why nuclear works with tons of charts but I am lazy so I won’t do that. I’ll just use what the market is doing as a proxy to show that the nuclear cycle is inflecting.

For those who don’t know, nuclear was in an upcycle for years post WW2, after all, it’s the most efficient and reliable way to produce clean power humans have ever come up with.

Then in 2011, earthquake hits Japan, tsunami hits the Fukushima nuclear reactor, and catastrophe ensues, something we haven’t seen since Chernobyl and those were idiot commies! We can debate why this happened, but I don’t want to.

I am skipping a ton of phases, if you’re curious, the book Atomic Awakening provides a nice fun read on the history of nuclear.

Nuclear then enters a downcycle, uranium prices suck, all newbuilds get shelved (outside China), and a bunch of countries decide to massively reduce their nuclear footprint, with the most extreme case being Germany.

When you sell valves to nuclear reactors, this sucks.

I believe we’ve just entered an upcycle in Nuclear. It’s been more than a decade since Fukushima, we’ve built tons of renewables which have de-stabilized the grid, and the outlook for power consumption is now the highest it’s ever been driven by data center demand and the electrification of our economies (EAF steel instead of blast furnace, EVs, electric water heaters…).

At the same time, Western countries have done their best to get rid of the main source of reliable baseload power they have, coal, and in some places, natural gas.

What this means is you add renewables which are intermittent in nature, and get rid of baseload which you can flex up and down, which means when the wind doesn’t blow and it’s night time, with no baseload you have no power.

The grid is signaling to you that it needs more baseload power, a great example is the recent PJM auction which saw a 9x increase in the price paid to baseload power producers to just exist in the grid, not even to sell power, just to exist. (https://www.powermag.com/pjm-capacity-auction-prices-surge-over-nine-fold-signal-urgent-need-for-new-power-generation/)

I am starting to fee like I ramble, basically, we need baseload power, politicians hate coal, and dislike natural gas. Nuclear is very efficient, and has very synergistic properties with renewables, see this handsome Australian fellow talk about this for a while:

Small Modular Reactors or SMRs seem to be an even better tool to please politicians because it’s new, there’s small in the name and so they’ll think it’s safer than big plants so they’re able to back it.

I am a strong believe in nuclear, I am neutral on SMRs, but if they become the norm, there’s a lot more valves per MW of capacity with SMRs than traditional nuclear.

Now these are just the words of a guy, but I believe the market is showing you the signs:

Record amounts of nuclear reactors now under construction in Eastern Europe to become more independent from natural gas. Some examples of planned & proposed projects in Esatern Europe:

Poland 13.8GW

Romania 2GW

Slovakia 1.7GW

Slovenia 1.2GW

Ukraine 12GW

US keeps running their existing nuclear reactors at higher utilization rates now that their power is a lot more valuable

Good if you sell valves which you need to replace

US keeps re-starting idled reactors, or reactors that were supposed to be decommissioned.

Most emblematic is 3 Mile Island, which had a nuclear meltdown that marked the US’ psyche, so the signal this sends is powerful. Constellation Energy owns it and Microsoft will pay for the power.

Palisades re-start.

And recently the US DoE announcing they plan to keep re-starting reactors and even provide some form of funding.

China has been building for years aggressively and will keep building.

What does this mean for Velan? Well more valves sold, and we’ve seen that and will keep seeing it in bookings. But beyond that, there’s rarity in having nuclear exposure.

If you find a stock with 20-30%+ of their revenue from commercial nuclear please share because I only know two, one at 16x EBITDA (which is still great), and Velan.

I think if the cycle keeps evolving in the right way, this will prove extremely valuable given the rarity of the exposure.

If you play with Curtiss Wright or BWXT’s implied commercial nuclear multiple you get to crazy numbers in the 20x+ EBITDA range.

Threat 2: The Margin Story

Velan’s margins are extremely volatile, and it’s difficult to get a clear picture of what “normalized margins” are. This is driven by a couple things:

Flowserve transaction led to a lot of incremental legal and M&A costs, and put management’s attention away from the business which has been pressuring margins up until recent quarters.

Velan is being sued by former US navy soldiers for alleged asbestos-related diseases. The former management team treated those things in a cash basis, only recognizing expenses when they happened, so whenever you had to pay a lawyer or settle with somebody. When James the new CEO came on, he took a very large $70M charge to reserve for future potential losses, which he buffed up by another $10M a year later.

Significantly under-utilize plants. I can’t tell you how much because they don’t disclose it, but it’s not that hard to figure out. Velan had to live through a nuclear downcycle, and didn’t right-size a whole lot of its workforce or facilities, they’re likely running a very sub-optimal cost base vs the level of revenue.

What’s normalized margins today?

If you take FY23 and ex out the asbestos related costs, and some of the legal costs that were non adjustable related to the Flowserve deal, you get to Adj. EBITDA margins in the 10-12% range.

Based on Velan’s estimate of NTM revenue from backlog alone ($400M) that’d make normalized EBITDA about $45M (they report in USD so that’s a USD number be careful).

EV today at $9.5 CAD per share is $140M USD, that makes the stock 3x EBITDA. Now obviously there’ll be some re-occuring expenses related to asbestos, or some charge needs to be assumed in the EV, but you get the idea.

Where could margins go?

From my discussions with current and former employees of Velan, it sounds like it’s been run like a typical family business. Not a lot of oversight, not a lot of best practices, each plant worldwide running in a different way with independent procurement.

It’s also common in businesses like these to see pricing power be under-utilized. When you’re the default valve in 90% of nuclear reactors or refineries, which is a long process to be approved by regulators (not unlike aero parts), I’d think you have some pricing power built in.

This all sounds like something a new CEO with decades of experience at US industrial leaders can fix. I’d highlight that since he joined, James seems to have already started improving things, and the last two quarters are promising.

In Q1 2025, EBITDA margins were 5%, up from -5% the year before so 10pts of improvement YoY. In Q2 2025 EBITDA margins were 5.2%, and 5.5% excluding a 0% gross margin order that was cancelled, a 140bps increase YoY. Note that Q4 25 is by far the largest margin quarter ranging from 20-28% historically.

The margins of nuclear peers and industrial flow process peers range, but they’re all meaningfully higher than Velan, despite often being in more competitive markets.

In Industrial Flow Control FLS has 14% EBITDA margins, EMR has 26%, PNR has 25%, PH has 26%, GGG has 33% and the list goes on and on.

In Commercial Nuclear, Mirion’s nuclear segment has 26% EBITDA margins (which they’re guiding to 30% in the coming years), BWXT has a whole which includes mostly Defense Nuclear is at 19% EBITDA margins and CW’s nuclear segment has 15% EBIT margins and ballpark near 20% EBITDA margin wise.

All that to say, there seems to be a lot of room for improvements, which the new CEO seems capable to execute on and has acknowledged.

From James the new CEO at the latest AGM: “FY24 was a less than optimal year with $347M of revenue and $17.8M of EBITDA“.

Threat 3: take-out potential

This is simple, Velan was the target of a take-over in the past, Flowserve probably didn’t expect this pushback from France, but they offered a 130% premium, at a time when the nuclear cycle and sentiment hadn’t inflected like it has today.

The take-over offer likely already under-valued Velan but the high headline premium pleased shareholders. Now that nuclear is now all the hype, and there’s little ways to play it, I expect tons of strategic and PE interest.

An interesting thing to note, in the last process, there was interest from 101 buyers, 65 NDAs signed and 11 initial offers with 2 taken to the last step.

Velan just became much more interesting macro wise, and there was a ton of interest back then.

What’s tricky is finding the right buyer, but I do believe many could do it. A French buyer makes a ton of sense, ranging from Ardian the largest French PE fund, to strategic local players like Framatome.

It could be a Canadian company, Canadian PE fund like Onex or Novacap, or could even be another US buyer that isn’t Flowserve and doesn’t have the same history with the French government. It’s also worth noting that the minister who blocked this deal is now gone.

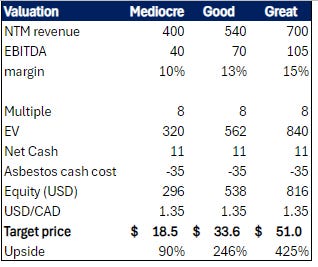

So what is it worth?

I am going to do it today. What i’d call mediocre, just what’s in backlog, even tho orders are massively inflecting let’s assume they flat-line and this is as good as it gets.

In backlog today, there’s enough orders for NTM revenue to be $400M. I think their underlying EBITDA margin ex asbestos and FLS deal noise is about 10-11%, say 10% to be conservative. That’s $40M USD of EBITDA.

Good is what I think they can do based on their existing manufacturing footprint with just some help from the nuclear cycle.

Great is a big upcycle in nuclear, I took prior peak revenue of $500M USD and added some inflation since it was 10+ years ago.

At 8x EBITDA (very cheap vs peers) that’s quite a bit of upside under all scenarios.

I also assume $35M USD of asbestos related cash costs. They provisioned $70M but not all of it is cash and it’s payable over 30 years, so I think my number is fair.

The risks

There’s always a bunch of risks. It’s a small cap Canadian industrial that’s family controlled and is up a good chunk YTD. Below are the main ones:

Most of their workforce is unionized. Makes it difficult to reach the margin levels of some of the best peers in the 20s to 30s EBITDA margins. There was a strike at a tiny plant in Vermont but it was resolved in a week.

Nuclear cycle loses its momentum. Even then I think the stock is fine but that’s a risk to the upside.

French government perpetually blocks any deal that isn’t French. Seems unlikely, France has strong diplomatic ties to North America, but who knows.

Asbestos charges end up being much larger. I won’t elaborate on the case but from what I read it’s a bit of a ridiculous suit, the asbestos was very rarely in contact with them, but that’s the most unpredictable risk. The company has a net cash balance sheet and this only affects a small end market only in the US so I think the new CEO has been plenty conservative.

Conclusion

I think it’s a pretty good story. It’s my #4 position but that may change.

I am biased I own shares in Velan (VLN.TO), this is not investment advice, please consult with your financial advisor or a financial professional before making investment decisions. These are just my opinions.

Can you point me to where you saw Velan products are in 90% of nuclear plants and refineries?