Pioneer Power Solutions (NASDAQ: PPSI)

Growth stock inflecting to profitability trading at a cheap multiple

I’ll start by saying this is not financial advice, and to not rely on this for investment decision, I am just sharing my thesis with the world, but I may buy or sell at any time without updates (tho I will try to update as much as possible).

I own the stock so I am biased, it’s actually my largest position today after having sold my prior largest position, TSSI.

Company overview

Pioneer Power Solutions is an American electrical designer and manufacturer of electric power systems, distributed generation equipment and mobile EV charging solutions.

The business started its life in February 1995, through the acquisition of Pioneer Transformers in 1995 from Schneider Electric. They grew that business into more value-added products, and tripled revenue.

In December 2009, they came public as Pioneer Power Solutions. They then ended up consolidating more transformer manufacturers through multiple acquisitions. They also bought various switchgear, and electrical infrastructure businesses over time, which laid the foundation for the e-Bloc and e-Boost product that drive the business today.

Then in 2019 they started simplifying the business. They sold their Pioneer Critical Power (PCPI) business to Cleanspark (NASDAQ: CLSK) for $4.4M. But most importantly, in July of 2019 they sold the entire transformer business for $65.5M to a Private Equity fund.

They sold that business for 1.5x their market cap and took a big chunk of the proceeds and did a $1.37 special dividend. So, while the long-term chart might not look great, you need to adjust it for the massive windfall they gave shareholders with the $1.37 special dividend.

This left them at the end of 2019 with two businesses: Pioneer Critical Power which manufactures generators, enclosures, uninterruptible power supplies, batteries and remote monitoring solutions as well as a full suite of engine generator maintenance services; and Pioneer Custom Electrical Products (called Electrical Infrastructure today) which manufactures complex engineered solutions for the distributed generation and data center markets.

These businesses took their expertise in all these independent electrical products and tried to build full solutions to solve specific problems. They built two flagship products that now drive the business, e-Bloc and e-Boost, who were launched in 2020-2021.

Electrical Infrastructure (e-Bloc)

2023 results: Revenue $30M, Gross profit $6.1M, EBIT $4.4M

While called electrical infrastructure, the entire business is driven by e-Bloc.

From a technical point of view, e-Bloc is the combination of an automatic transfer switch, circuit protection, special programmable controls into an integrated outdoor system, essentially a box.

What does it actually do? E-Bloc is the traffic cop of electricity, it’s a microgrid that allows you to use multiple sources of power as the user. A common mix for example is having power from the grid, a natural gas generator and a solar module + battery system all linked through e-Bloc.

What’s the purpose? It allows you to use multiple power sources, not just as back up, but for continuous use. Having multiple sources of power allows you to draw more power than the grid would allow you (particularly useful for very power-hungry activities, wink wink data centers), to increase reliability (if one is down you can use the others), and to reduce electricity bills, since you can switch between sources of power by which one is the cheapest at any given time.

Who uses it? Anybody who requires a lot of power, for whom power is a large cost, and/or who needs reliability. The company lists its main end markets as electric/gas/water utilities, data centers, EV charging infrastructure and distributed energy developers.

A good example of a customer is HEB, the supermarket chain, who during the recent hurricane in Texas still had power for its EV charging station thanks to e-Bloc, or the Ford EV campus in Mississippi.

Critical Power Solutions (e-Boost and Service)

2023 results: Revenue $11M ($7.7M from services, $3.4M from e-Boost), Gross profit $2.2M (services is profitable, e-Boost isn’t), EBIT -$2.5M

This segment has two main sub-businesses. We’ll start with the more boring legacy one, services.

The services business is simple, they service generators and uninterruptible power systems (called UPS, often used in data centers). It’s a high 20s low 30s gross margin business that’s been representing about 70% of segment revenue over time.

This is likely to keep hovering around $7-8M a year and is not the focus of the company. It’s just a nice profitable fairly re-occurring business.

The real growth driver here is e-Boost.

e-Boost is a line of products that at their core all do the same thing. They’re EV charging stations that can be run off-grid, are mobile, powered by generators that can use natural gas or propane.

e-Boost only deals with fast charging and is the only one offering this type of product. It’s a convenient way to guarantee fast charging anywhere, even when the infrastructure doesn’t allow it, or serves as a great back-up.

The primary customers are school districts or school bus operators, commercial bus fleets, ATVs like Bombardier Recreational Products, and in some instances passenger vehicles.

e-Boost is a fairly new product, but it went from making $2.2M of revenue in 2022, $3.4M in 2023, and as of Q4 2023 had $16.5M worth of orders in backlog, with $13M+ of announced orders YTD. It was unprofitable in 2023 due to lack of scale but will turn profitable this year.

Capital structure and management

Clean capital structure with $3.2M of cash on balance sheet net of any debt.

As far as management goes, the company is run by long time CEO Nathan Mazurek, who’s a veteran of the electrical manufacturing business.

From the ownership data I could find he is the largest shareholder owning roughly 20% of the company. His pay is nothing crazy with a total compensation of $500k in 2022.

He’s been CEO since the company came public in 2009, when he was paid $250k, so his total compensation has only CAGRed at 5%.

He also has a history of being shareholder friendly given the fact that he sold the transformer business for 1.5x the market cap in 2019 and did a huge special dividend of $1.5.

It’s also worth noting that Nathan the CEO has bought shares in the open market multiple times, not massive amounts but significant, including $60k when the stock was trading at $6.1 in September of 2023. A pretty significant sign that he saw value even prior to getting tons more awards and at a much higher price.

Investment thesis

e-Bloc solves a lot of the electrical grid’s problems and should benefit from continued growth.

There are thousands of news articles around the lack of resiliency of the electric grid, the demand for power that AI brings through highly energy intensive GPUs, and the barriers to electrifying North America, so I won’t explain everything, but below I’ll list the big problems e-Bloc solves.

Resiliency

Having e-Bloc means you can integrate multiple sources of power, like the grid, solar+battery and natural gas.

HEB is a customer of e-Bloc, so when Hurricane Beryl hit Texas, having their own microgrid through e-Bloc, they were able to conserve power and keep running while everybody around them lost power.

A great article on this here: https://www.chron.com/news/article/heb-microgrid-energy-plan-19594738.php.

As these kinds of grid outages like the Texas Winter Storm keep happening, having the ability to keep running during tough times is extremely valuable.

Lowering your electricity bills

When it comes to electricity costs, a common practice is called peak shaving. What this means, depending on the context, is that you’ll store energy when it’s not profitable to sell it, and sell it later.

e-Bloc achieves a similar outcome. By having 2+ sources of energy, you can switch from one to the other automatically depending on which one is the most cost advantageous. During the day solar might be cheapest so you use that instead of pulling power from the grid, and at night you can use the grid, and if the pricing of grid electricity surges, you can always run your natural gas or propane generator.

This is a significant cost saving for power hungry customers like utilities, data centers, EV charging or even some commercial customers.

Pulling more power than the grid allows you

The grid is in tough shape, and sometimes you require more power than the grid is able to provide you. When this happens, you can use e-Bloc’s other sources of power to add kW.

If the grid allows you to fulfill 80% of your needs at a given moment, you can use your other independent sources of power for the remaining 20% instead of limiting yourself.

I believe this explains why e-Bloc has been such a great product since its launch, see below with my forecasts for the future:

So, e-Bloc solves a bunch of problems. But why will it keep growing?

First, I think momentum is very strong at Pioneer Power. Their tone on business has been very upbeat on the latest earnings calls, and on top of that, they’ve been press-releasing a couple big orders since the start of the year like a $2M+ order in February for delivery in Q2 2024, and multiple orders in June worth $7.2M.

But why fundamentally will they keep growing? Well, all the problems they solve are problems fast growing parts of the economy are trying to solve.

Resiliency is a growing issue as the grid keeps deteriorating, bringing more and more customers to look at their resiliency.

Data centers is a huge growth area for e-Bloc, they already list it as one of their main end markets, but AI data centers being 9-10x more power hungry, the need for more power that the grid may not be able to supply, coupled with the need for reliability and cheaper power makes data centers one of the greatest end markets they can go after.

EV charging is in its infancy and growing very fast in the United States, and e-Bloc is a key enabler of that, especially on the solar+battery side.

Lastly, electric utilities are in secular growth mode because of all these drivers for electric demand growth (AI data centers, EAF, EVs, etc.), and they’re a large end market for e-Bloc.

According to my research they have around $50-60M of revenue capacity under their current footprint in California, and given the levels of demand and the momentum, I wouldn’t be surprised if they get near those levels in 2025, at least on a run rate basis.

This implies a near doubling of revenue coming off two years of 70%+ growth.

I do believe however that 2024 will still grow but at a much slower pace but pick back up exponentially in 2025 given the timing of orders and the commentary on their recent press releases.

e-Boost growth inflection will lift EPS significantly.

Before I start speaking growth and product here’s what you need to know.

e-Boost was $2.2M of revenue in 2022, and $3.4M in 2023. Management has said that the service business has gross margins in the high 20s low 30s in the past and that e-Boost in 2022 and 2023 was unprofitable given the lack of scale.

If we do a bit of math, we realize that e-Boost in 2023 was likely gross profit breakeven, and responsible for all of the R&D, and a good chunk of the SG&A (the critical power segment runs at twice the SG&A as e-Bloc which is much larger).

Ballpark, e-Boost on 2023 results was likely a $2.5M drag to EBIT, or $0.25 per share.

This means that e-Boost inflecting to profitability in 2024 means a meaningful lift in EPS.

e-Boost is the only one out in the market with their solution, it’s a crafty way to solve a growing problem when it comes to EV charging.

Lots of companies want to build chargers and develop them, but nobody came up with a portable and off-grid solution, e-Boost did.

I don’t give too much thought to these industry forecasts but for what it’s worth the EV charging infrastructure market is supposed to grow at a 29% CAGR through 2033. That’s not a crazy thought given the size of the EV transition and the still early days of the infrastructure roll out.

On top of being a great solution for reliable off-grid EV charging, e-Boost has a big advantage in today’s world. Having your new EV charging station connected to the grid today can take years given the backlogs in permitting and the ability of the grid to fulfill your demand.

This is from an article on California’s growing need for EV charging and the main hurdles to achieving it:

“One of the biggest barriers to more chargers isn’t money. It’s that cities and counties are slow to approve plans for the vast number of stations needed.”

The beauty of e-Boost is you don’t need permits and you don’t need access to the grid. That’s a major advantage in today’s world.

Below are the historical numbers and my forecasts to better illustrate what I am talking about:

Now bear in mind these are very speculative forecasts, but it’s helpful to frame the opportunity.

First, e-Boost is going from $3.4M of revenue in 2023, to a backlog of $17M as of YE23, and $13M+ in incremental orders announced through press releases YTD.

An interesting tidbit as well is that in their June 7th press release announcing a $5M+ order, they wrote this:

“With this order and its current backlog, the Pioneer eMobility business unit is expected to surpass the 2024 guidance of $10 million in revenue of mobile off-grid EV charging solutions in 2024. The Company expects to deliver and commission this specific order in the fourth quarter of 2024.”

So, we’re going from $3.4M in 2023 to $10M+ in 2024, with tons of orders announced for 2025 already implying they’re already fully booked for 2024.

Another tidbit that shows how strong business momentum is at e-Boost is in their June 11th press release announcing a $7M+ order from a school:

“The receipt of this order, combined with the current backlog for Q1 2025, positions the Pioneer eMobility business unit for significant growth in 2025, exceeding its expected 2024 performance. To support this expansion, the business unit will form strategic, geographically aligned partnerships with national manufacturing firms, thereby increasing production capacity and enabling Pioneer to meet growing demand while avoiding costly facility expansions and potential production delays or disruptions."

If they’re already looking to expand capacity, it’s a good sign of how good business is at e-Boost.

Now the massive financial impact this has is turning e-Boost from an unprofitable business to what could be the highest gross margin business at PPSI has a massive effect on EPS.

I think the e-Boost inflection is a big driver behind management’s guidance for 2024 of $0.31-0.34 of EPS.

Catalysts

Normalization of their filing issues

Around April PPSI started running into accounting issues and filing issues.

The stock is down about 25% from the moment they started having these issues.

I don’t believe there’s any foul play, management is well aligned, has been honest with the issues, and the restatements have happened with no cash impact and no big issues on reported results.

At the same time, it’s fairly common for microcaps to run into issues when it comes to delaying filing.

Now what was the actual problem? In late 2021 after e-Bloc started gaining momentum for the first time when they logged their first big order, they went to their auditor to ask how to book this kind of revenue, the auditor recommended to book revenue as the costs are incurred since they’re non-cancellable purchases orders.

But then when Q4 23 came, the auditor came back and said they made a mistake, and that they should recognize the costs as incurred, and revenue upon delivery, a more punishing treatment but no change cash wise.

This meant a lot of time wasted restating every quarter since Q1 22.

This is the reason why they have yet to report Q1 24 results.

The good thing is this issue is essentially over. They’ve done the hardest part having filed the 10-K last week, and are likely printing Q1 results this month, with Q2 following in September, and after that will basically have solved the issue permanently.

This removes a significant overhang off the stock.

2024, a tale of two halves

So, we’ve established that in the coming 30-60 days we should see them report Q1 and Q2.

Here’s how I think this will play out.

Given the timing on the delivery of orders announced, and the commentary on the Q4 23 call, H1 will showcase decent performance but nothing crazy, it’ll be muted with e-Boost approaching break-even, and the overall business likely being unprofitable for the first two quarters. But in Q1 and Q2 I expect significant growth in backlog showcasing the momentum the business is experimenting. I think that alone is enough to get the stock going despite the muted results.

Then H2 is when it really gets explosive, with tons of orders falling in H2, they’ll generate more than their $0.31-0.34 of EPS in H2 alone, showcasing how much earnings power this business can sustain.

Segment wise e-Boost will get to $10M+ of revenue, and e-Bloc will grow nicely but not at the 70%+ pace of 2022 and 2023, not reflecting demand slowing, but the timing of deliveries.

Beyond that I think 2025 shapes up to be even better. Virtually all of the orders announced so far in 2024 are for 2025 given they’re fully booked up for 2024. They’re actively expanding capacity on the e-Boost side and re-jigging their facility on the e-Bloc side to handle more exponential growth in 2025.

Potential separation of the two businesses

As far as I’ve seen, outside their ability to go to market on the EV side with both products, the two businesses don’t need to be in the same company.

I think it’s possible that we see a sale of the service business or one of the two segments given the history of shareholder friendly actions by the CEO like the 2019 sale of the transformer business and the subsequent special dividend.

Risks

I’ll do this quickly, a couple of the risks I can foresee:

Accounting and filing issues continue. They filed the 10K which is the hardest part and seem confident in their ability to print Q1 and Q2 in the next 30-60 days but that could be a problem.

E-Bloc facing tough comps in 2024 after two record years, I still think they’ll grow but it’ll be at a slower pace and will then re-accelerate in 2025. Not much of a real risk but an optical one for the stock.

Trump election cuts a lot of funding for EV infrastructure and EV subsidies. I just don’t see it given that a lot of power on this doesn’t rely on the president, it’s had support from both parties on a lot of topics, and the hot topics are more subsidies for passenger EVs, less debate around commercial and school buses which are large end markets for PPSI.

Lumpiness. PPSI’s business is inherently lumpy and an order shifting from one quarter to the next can have a big impact on a given quarter. This is what will likely lead to a slow-ish H1 (but with strong backlog growth) that won’t be profitable and a record H2 and 2025.

Valuation

Let’s start with the 2024 guidance. PPSI guided to revenue of $52-54M and EPS of $0.31-0.34 in 2024. This means the stock today trades at about 13x earnings.

A very reasonable valuation considering how fast the company has been growing, the business momentum and the fact that e-Boost is just starting to inflect from a profitability drag to a profitability driver.

It’s difficult to compare it to others, large cap electrical OEMs like Eaton or Hubbell trade in the 30x earnings range but are not fair comparisons, so we’ll stick to “where can numbers go” to assess the upside.

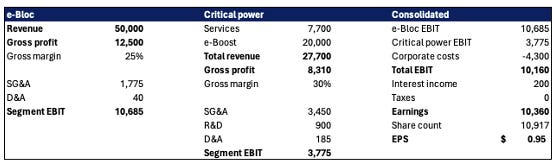

On 2025-2026 numbers, so likely to be achieved on a run rate basis through 2025 in my opinion, I think e-Bloc can get near its capacity at $50M of revenue, with a targeted gross margin of 25% and SG&A around flat as operating leverage kicks in.

Then on critical power, I assume the service side remains flat at $7.7M, and e-Boost grows to be a $20M business.

I think this can prove to be very conservative given the momentum they’re having on orders and how large the market is. They’ve announced over $13M of orders in the first half of the year for this business and its still in its infancy.

In recent press releases they’ve indicated they’re working on expanding capacity, and I don’t think that’s to get them to $20M.

I assume overall gross margins of 30%, given ramping e-Boost scale and service GM steady.

I also assume SG&A in the $3.5M range and R&D around $900k, around flat from 2023 given management seems confident in operating leverage kicking in, and a lot of the launch expenses are out of the way.

This gets me to $10M of EBIT and around $0.90-$1.00 a share of EPS depending on whether they pay taxes. They have a significant amount of NOLs which likely means they don’t have to pay taxes for a little while.

Now pick your multiple, but for a fast-growing electrical OEM tied to secular end markets like EV charging, data center, utilities and grid reliability, I think 15x is not out of the question.

Well, that’d get us to $13-15 a share, or around 220% upside from today.

Thanks for a great write-up. Any thoughts on capital intensity and cash conversion going forward?

Excellent write up. Assume you own. What is your average price and what is the weighting in your portfolio? Thanks.