This is to me one of the most assymetric situations I’ve ever seen, and one of the rare stocks I can get bullish on in this highly uncertain environment since they are a potential massive trade war beneficiary (with China in particular), and I believe works well in virtually any scenario.

Company overview

History

NEO traces back to 1994, with a couple of Chinese assets in rare earth minerals processing which then came public on the TSX in 1995 under the name AMR. That business then acquired a Neodymium magnetic powder company called Magnequench in 2005.

They then renamed themselves to NEM in 2006, kept doing some rare earth acquisitions, and then in 2012 ended up being acquired by Molycorp for $1.3bn, the only rare earth mine in the US which today trades under the name MP Materials (NYSE: MP).

Molycorp ended up spending billions of dollars developing the Mountain Pass mine in the US, and when a rare earth downcycle came about, they ended up having to declare bankruptcy in 2015.

Oaktree became the DIP financier during bankruptcy, they decided to bundle NEM and Molycorp’s refining facility in Silmet, Estonia, and bring it public under the name Neo Performance Materials, which is the company we’re talking about today.

Oaktree being a large shareholder meant they were an overhang on the ownership structure for years but now have no involvement in the business.

Business model

So what is NEO? NEO is a downstream processor of rare earths. This means they’re not in the mining business, but in the business of separating rare earths and turning them into useful things, and to a lesser extent, in the business of recycling.

They are one of the largest downstream rare earth companies outside of China, and the most vertically integrated.

Their primary exposure is to Neodymium, but they also deal with many other rare earths. They have an unbelievable amount of history and expertise in rare earths, and have actually created the NdFeB magnet used across the world today.

Below are the segments, I put the % of revenue but it’s not that important, i’ll put mid cycle numbers in my valuation:

Magnequench (37% of revenue)

Manufactures bonded NdFeB (Neodymium) powders and bonded permanent magnets. #1 market share in magnetic powders used in bonded and hot-deformed fully dense neo magnets. They use a proprietary process to manufacture Magnequench powders.

These powders are used in the production of bonded permanent magnets.

A neodymium magnet is essentially the world’s best magnet (available at commercial scale), and they’re used whenever you need to save energy since they bring on about 30% energy savings vs traditional ferrous magnets, primarily because they’re significantly stronger.

The main end market for Neodymium magnets is light vehicles, in particular EVs, but also ICE vehicles. They're also used in hard disk drives, printers, home appliances, residential heating and cooling pumps, consumer electronics and in factory automation robotics.

Pass-through business model where they earn a spread for the conversion and pass-through the material costs. Essentially an EBITDA/ton business.

Their Estonian facility is the main center of production.

Chemicals & Oxides (30% of revenue)

C&O is Neo’s rare earth separation and advanced materials arm. It processes light and heavy rare earths and turns them into oxides and further manufactures them into specialized chemicals. They used to have two large separation facilities in China called JAMR and ZAMR but Neo has just sold them. They were some of the company’s worst assets and added significant cyclicality.

These C&Os can be used for catalytic converters in cars, wastewater treatment chemicals, glass, energy storage, petroleum refining catalysts, chemical catalysts and electronics.

The segment today consists of two main plants:

NPM Silmet in Sillamae, Estonia

Processes light rare earths (lanthanum, cerium, praseodymium, neodymium) and small quantities of medium/heavy REEs. They produce rare earth metals that can feed into magnet production (in the Magnequench segment).

Silmet is one of the only rare earth separation plants in the Western World.

NAMCO catalyst plant in Zibo, China

Recently moved and expanded into a new state of the art facility with $46M USD of capex invested. NAMCO produces catalyst additives using rare earths, primarily for catalytic converters, but also some phosphor for LED lighting, wastewater treatment…

By early 2025, 4/5 of its largest customers had approved the new products. It’s the most productive plant in the world with the lowest cost.

80% of that plant is China for China so there’s minimal trade war risk.

Part of those C&O supply Magnequench.

Rare Metals (33% of revenue):

Combination of primary production (refining high-purity metals from ore or concentrate) and recycling. Focused on high-value rare metals like tantalum, niobium, hafnium, rhenium, gallium and indium.

It’s essentially a bunch of niche primary/recycling downstream assets in small rare earth markets. For example they make 50MT/year of Tantalum Oxide and 250MT/year of Niobium Oxide out of the Silmet plant, which goes into superalloys and electronics.

Their plants are Silmet in Estonia, a 50% JV in Germany called Sagard (with Buss & Buss), and a facility in Ontario, Canada.

This is the more volatile segment and can swing up and down quite a bit based on the pricing for this variety of rare earths.

Demand for these varies widely, but is usually for high value high complexity use cases like turbine blades for jet engines, alloys for aerospace, alternatives to silicon for semiconductors, for batteries, for nuclear power plants and nuclear medicine and for optics.

Investment thesis

You can break down my NEO thesis in two main parts:

First, NEO is a strategic asset trading at a ridiculously low multiple, with a net cash balance sheet, a 5% dividend yield, with a much improved management team, a company that sold its worst assets for 11x mid cycle EBITDA, and with two big capex projects coming to an end, and finally, in a strategic review to sell itself.

We’ll call that thesis point: “The base case is pretty epic”.

Second, NEO not only can work in a very rocky and uncertain macro environment, but it stands to benefit significantly from a full blown trade war, with a clear historical precedent to NEO earning many multiples of its current EBITDA in case of a trade war.

We’ll call that thesis point: “If the world goes to shit, at least we got NEO”.

The base case is pretty epic

Let’s start by establishing why it’s a unique asset.

If you read the news, or talk to people who think they’re smart ass, you’ve probably seen or heard that China dominates rare earth production to the point where without them the Western World is screwed.

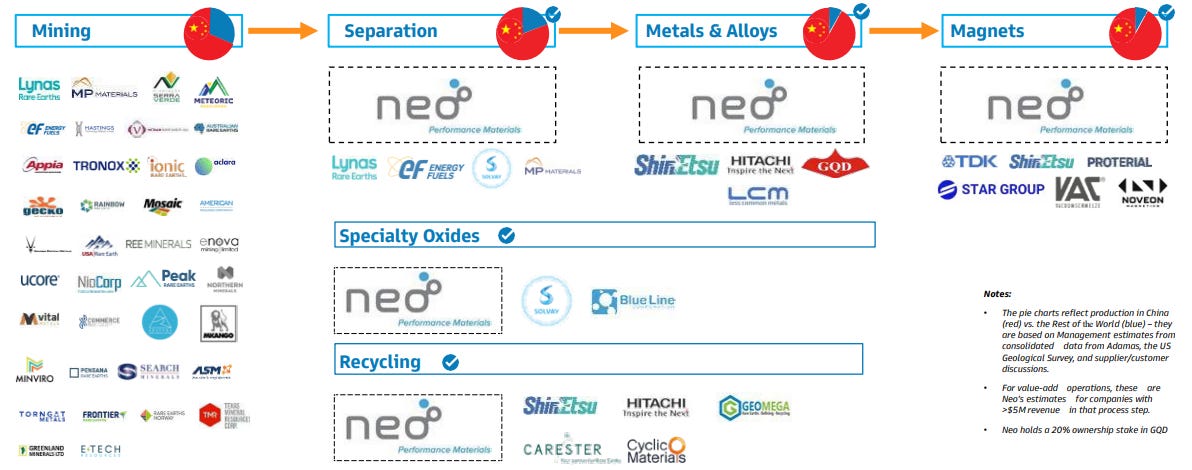

It’s true and it isn’t. Everyone talks about mining, but China “only” controls 60% of world rare earth production, however, they control 85% of the separation capacity, 90% of the ability to transform them into metals & alloys, and 93% of neodymium magnet production.

The real issue isn’t the mining, which by the way is a shitty business to be in, but it’s the downstream capacity, and guess what NEO does? Downstream.

You can count on your hand how many companies outside of China are able to make neodymium magnets outside of China. Thus why this is a unique asset.

Clean capital structure

I include a lawsuit they lost to Solvay even though they’re appealing and I tax the proceeds of the China sale tho they likely have NOLs they can use in order to be extra conservative.

Note NEO has a 5.1% dividend yield.

Improved management team

In May 2023, long time CEO Constantine Karayannopoulos retired after 25 years at the company and he stepped down from the board.

He was replaced by former CFO Rahim Suleman who’s worked for GE, Gates Industrial and a tier 1 auto OEM.

I think this is a huge upgrade. Constantine has been around since the days of Molycorp and to me was a bad CEO for NEO. He was an empire builder who did not run a tight ship and just accumulated assets. Working capital was poorly managed and so were facilities and capex plans. He did a lot of weird things like buy a stake in some Greenland junior mining project.

Rahim however is a really solid CEO. The first thing he did when he took control was get rid of low to negative ROIC assets, he sold a sub-scale asset in the US and most importantly sold two Chinese facilities in the C&O segment for nearly $30M USD, 11x last 5 year EBITDA avg, for an asset that was currently unprofitable. He released a bunch of working capital and tightened operations.

So far he’s executed on everything he’s laid out if not better.

A super impressive feat he achieved is finishing his Chinese facility move (NAMCO) early and at a total cost of $68M compared to the $75M initial budget, something you never see in today’s inflationary environment. He’s also done a great job on his Estonia magnet project so far on time on budget as well.

Two big capex projects at/near completion should lift FCF going forward

The first one is NAMCO, a separation facility in China that they moved and re-built entirely (closed down the old one) for $68M.

It’s now the most advanced lowest cost facility in the world, and it was finished as of September 2024, and they’ve now re-qualified their new product with virtually all of their former customers so it should start contributing to EBITDA very soon, and will no longer be a big capex drag.

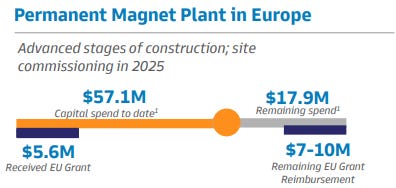

The second one is even more important, it’s their new Permanent Magnet facility in Estonia. This is the largest rare earth project in Europe’s history, and one only NEO could do at this cost and scale given their 30 year experience in China.

The facility is very close to being done, with sample production having already started and only $18M of spend left, with $7-10M of that paid for by EU grants, so minimal capex left.

Phase 1 will be done in 2025 and will contribute to EBITDA in 2026, management has essentially communicated $15M+ of EBITDA coming from phase 1 (2,000 mt/year), but with phase 2 this could go up to $30M of incremental EBITDA given the operating leverage, but this is for later.

So essentially, the company has spent over the last 2-3 years around $125M with 0 EBITDA contribution in current results, now there’s only about $7-9M of net capex left to spend, and incremental EBITDA of $20M+ (I don’t have a number for NAMCO, likely higher than the $5M I am assuming here) between the two facilities.

Absurdly cheap

So now, if we take the PF cap structure done earlier, add the capex left to be spent and try to get to a mid cycle EBITDA, we can see just how cheap NEO is.

3.2x EBITDA for this incredibly unique asset.

Let’s just remind ourselves, Molycorp bought Neo Materials for $1.3Bn in 2012, and back then they had less assets than today, they didn’t have the Silmet facility in Estonia, didn’t have phase 1 of the new Estonia project, didn’t have the brand new NAMCO, and inflation adjusted that $1.3bn is $1.8Bn today.

Let’s put this in perspective another way. Neo just spent $135M on two plants that aren’t even contributing to EBITDA today, and its total EV is $217M.

Rare earth mining businesses, which are objectively worst businesses and way less rare than NEO, trade at incredibly expensive multiples, the best examples being MP Materials (former Molycorp) and Lynas in Australia. They respectively trade at 17x and 15x 2026 EBITDA.

Another perspective, since NEO came public after Molycorp’s bankruptcy, its traded at about a 5x EBITDA multiple, pretty miserable and more understandable given the Oaktree ownership overhang, questionable CEO, followed by an overhang from a bankrupt junior miner owning 20% of the company, and in a world where there was nowhere near today’s amount of focus on rare earths as a national security priority.

Lastly, for even another way to look at it, specialty chemical stocks trade anywhere from 6-10x EBITDA. I’d argue given the strategic nature of rare earth capacity outside of China it’d deserve a premium to the group.

Anyway, all that to say it’s dirt cheap, but what are they going to do about it?

Strategic review

Yeah so turns out there is a pretty clear possibility of realizing that value.

In June of 2024, the board initiated a strategic review, and so far no news.

Here’s my thought, I am not counting on this, I am happy to own it if it doesn’t sell. Now that’s not because I don’t think there’s bidders, I think there’s a ton that want to own it, the question is who can credibly own it?

This is a company with assets in Canada, Europe, Thailand and China. You need the approval of all these countries, which greatly limits who the bidders can be, and makes the situation quite tricky.

Now this isn’t insurmountable, after the sale of the two Chinese assets and the build out of Estonia phase 1, I estimate nearly 85% of yearly EBITDA will come from outside of China, and they are clearly the blocking factor on a deal.

I think this could end up like Velan, where the French were blocking any possible deal. Sell all Chinese assets to a Chinese buyer first, then sell everything else to whomever you want, but that takes time.

Now who would want to buy this? Well clearly at this valuation just about anyone, but let’s focus on a couple of examples of credible bidders:

MP Materials: they have a big focus on making Neodymium magnets, they’re building a plant in the US costing a fortune per ton, and let’s remind ourselves that they have already acquired NEO in the past. They went bankrupt after but primarily because of their stupidity on the mining side, and at 100% premium, they’d only be paying $400M, way less than the $1.8Bn inflation adjusted they paid for it in 2012.

Lynas: very similar, a mine aggressively pushing downstream who’d love to buy vs build given how hard it is to do.

Andrew Forrest: he is the Aussie billionaire founder of Fortescue mining, one of the world’s largest miners of iron ore. He already owns 20% of the company through his holding company Wyloo Investments. He is worth $14bn USD, and has taken a particular liking to the idea of having a mine to magnet rare earth company.

One of the Japanese neodymium downstream companies.

So to be clear, given the complexity of selling NEO, I am not expecting an offer in the near term, and I am actually long for the sake of the story, not just a quick sale, but I can’t ignore the real optionality of a buyout at a significant premium.

If the world goes to shit, at least we have NEO

Alright, so this is when I add a bit more differentiated value. The market is scary at the moment, Trump might be leading the US into a full blown trade war, especially with China.

He has put massive reciprocal tariffs on China, and then when they fought back raised their tariff rate to 104%. China has started fighting back by banning the exports of 7 rare earths (https://www.reuters.com/world/china-hits-back-us-tariffs-with-rare-earth-export-controls-2025-04-04/). So far this is on 7/17 rare earths and not the most important ones, it doesn’t include neodymium. Neo has a bit of exposure to these but it isn’t huge. What it is is a sign of what China will use as a fighting tool against the US.

As I said, China controls 60% of the mining of rare earths, but 93% of the magnet market, and they can really use it to hurt the United States and the West.

I think there’s a very good chance that this trade war ends up with neodymium export restrictions, and there is a historical precedent for this.

In Q3 of 2010, China raised export restrictions on Japan (which processed virtually everything outside of China for the US back then) after Chinese and Japanese ships collided and Japan took custody of the captain. It was basically tensions around China venturing further and further into the Japanese sea.

So this has been a tool they’ve used before. But what does it mean for NEO if this happened today?

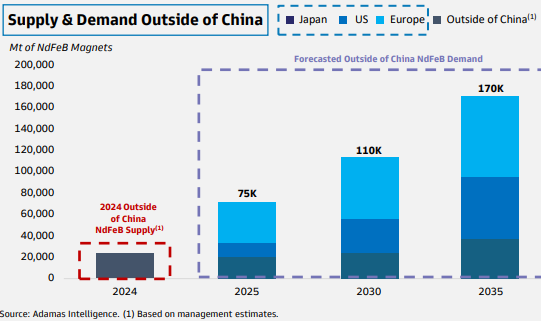

Well supply of magnets ex China is around 20k MT, and demand ex China is 75k MT, forecasted to grow sharply.

What happens if you take out Chinese supply? Then the few companies like NEO that control a large part of the supply ex China will see their spreads blow higher.

This means a ton of EBITDA, especially once Estonia phase 1 is fully contributing in 2026.

Want another proof that NEO could benefit in an epic way from a trade war with China? Neo was actually public under its prior form before being acquired by Molycorp when the Japan incident happened, and had less capacity than today. Let’s see what happened to their EBITDA:

Yes, EBITDA went from $35-50M mid cycle to $285M by 2011. A massive tailwind to NEO, and the stock exploded higher and eventually got acquired by Molycorp:

I believe the set up is very similar, except that this time around, these export restrictions aren’t over fishing boats with Japan, but the US bullying China with 104% tariffs, calling them parasites on live TV (thanks Navarro) and both sides digging themselves in.

I could try to give you an estimate of EBITDA if this happens but it’s very difficult, here’s an easy way to think about it. NEO went from mid cycle EBITDA of say $40M to $285M in the last crisis, the same scale today would mean EBITDA goes from my mid cycle number of nearly $70M to almost $500M of EBITDA. Just a reminder that the EV of NEO is $200M.

Not saying this is what happens, but this frames the “upside of epic proportion” and has a historical precedent backing it.

Risks

Rare metals segment over-earning: due to a big rise in hafnium prices they’ve benefited and it’s earning above mid cycle, but management has actually said prices remain strong (tho not all time high) and they signed a lot of contracts for 25-26 already. I don’t include that in my mid cycle number anyway.

Strat review falls through: this isn’t impossible and given how long it’s been (nearly a year) I don’t think the market is pricing in a take out. I don’t think it’s the lack of bidder the problem, I think it’s getting regulatory approval that is and I think selling the two China assets was a step in the right direction.

Economic meltdown + no trade war: truly the worst case scenario and not sure how it pans out, either tariffs go away and economy is fine, not bad for NEO, or there’s a tariff war and a recession, not bad either.

Cost over-runs and delay with Estonia phase 1: messaging so far has been the exact opposite, it’s on time on budget, and NAMCO was actually early and cheaper so I am not worried here.

Valuation

I provide a lot of my numbers in the write up but let’s keep it simple.

Rare earth stocks on the mining side trade an insane multiples for mines (shitty businesses) around 16x 2026 EBITDA, specialty chemical stocks around 6-10x.

I think in a base case, without export restrictions sending EBITDA to the moon NEO could be worth something like this:

In light blue is what I think is reasonable. But given the mines trade at 16x who knows…

But if you think about the upside in case of a trade war with China that leads to export restrictions, EBITDA could go to $250M, $350M, $450M, who knows. Last time this happened would indicate nearly $500M but obviously impossible to say.

But the point is, there’s really good upside (100%+) if nothing happens, and incredible upside if something does happen.

I own shares in Neo Performance Materials (TSX: NEO). I may buy or sell at any moment without disclosing it. This is not financial advice this is for entertainment purposes only.

Solid Write-up - pretty timely too

Thanks for the writeup! What caused the drop in revenue for 2023 and 2024?