I figured I’d write a longer form pitch of Boat Rocker Media since there’s been a lot of demand and enthusiasm for the idea on Twitter.

For some background I’ve been involved in small size in the stock since early 2024, and had been involved with one of its comps in Canada. I 4x the size of my position around $0.90 on the Friday news.

History

Boat Rocker Media is a Canadian content producer focused on scripted TV, unscripted TV, documentaries, kids & family entertainment and until recently, artist representation.

The company was founded in 2003 by Ivan Schneeberg and David Fortier, who are still involved in the business as co-executive chairmen. They were both lawyers by trade at Goodmans together, focused on the entertainment industry.

They built BRMI over time through multiple acquisitions starting with Temple Street Productions in 2006.

They kept developing all kinds of IP over time and did multiple acquisitions.

BRMI has always had impressive backers, the BBC took a minority stake in 2008, then in 2015 Canadian Insurer and Investor Fairfax Financial took a majority stake, and bought out the BBC’s stake to become the largest shareholder.

In 2021 at peak valuations for content assets and at the peak of the streaming wars Fairfax brings Boat Rocker Media public on the TSX.

Fairfax did not use this as a liquidity event tho, they actually participated in the IPO and increased their stake by 3M shares for $30M.

The largest shareholders today are:

_Fairfax Financial: 13.9M multiple voting shares + 11.4M single voting shares.

_David Fortier (co-executive chairman): 4.3M multiple voting shares + 420k single voting shares.

_Ivan Schneeberg (co-executive chairman): 4.3M multiple voting shares + 428k single voting shares.

_John Young (CEO): about 1M shares.

The business model

Boat Rocker is in the business of producing content, and selling it to streaming services (Netflix, Prime, Hulu…), broadcasters (CBC, BBC…), and just about anybody else who distributes content.

Boat Rocker’s revenues are split the following way:

70% production revenue, 15% service revenue, 5% representation, 10% distribution.

Production revenue is derived from company owned IP (or partially owned), they often take the form of license fees paid by the buyer either upfront or as the shows get delivered (when they air).

With production revenue, there’s greater risk and greater reward, BRMI will invest some capital in building a pilot, will go around and try to secure commitments for it, and then after some financial commitments by buyers, they’ll go out and make the movie/show/documentary. If it flops, you get money for the first season/movie, and if it works well, it could turn into a game changing IP.

The best example of this is EntertainmentOne, who came up with Peppa Pig and created billions of dollars of value off owning that IP.

Distribution revenue is linked to production revenue, it’s when you take your company owned IP and license it abroad or get royalties for consumer products (t-shirts, toys…).

An example of production and distribution revenue is Orphan Black for BRMI. A show with 5 seasons where BMRI owns the IP.

Service revenue is lower risk, steadier, capital light business. Here a customer like CBC or Netflix will go to Boat Rocker with an idea, and request that they set up filming, production, casting, etc. In exchange they get paid a pre-established margin.

An example of this is the Great Canadian Baking show for BRMI.

Lastly is representation which I explain below.

The segments (2023 numbers inclusive of representation):

Television (80% of revenue, 62% of segment profit): primarily company owned IP alongside some service revenue.

The two big categories are scripted TV like Beacon 23 on MGM+, Invasion on AppleTV, Orphan Black Echoes on AMC Networks; and unscripted TV so think documentaries, reality TV, things like Downey’s Dream Cars on MAX and the Great Canadian Baking show on CBC.

Kids & Family (14% of revenue, 21% of segment profit): 2/3 of that business is service and the rest is company owned IP. It’s the steadiest and most predictable business because of the service component, and also because Kid’s content is always in high demand by streaming services since it’s the stickiest.

IP includes Dino Ranch on Disney+ or Daniel Spellbound on Netflix.

Representation (6% of revenue, 17% of segment profit): this represents Boat Rocker’s 51% stake in Untitled Entertainment, an LA based talent agency representing stars like Chris Rock, Penelope Cruz, Dakota Johnson…

As of Friday June 28th, they have sold their stake to TPG, but they retain an 8.8% stake in TPG’s new representation platform, where Untitled is the first acquisition.

Lastly revenue by geography is 78% United States, 19% Canada, 3% other.

Capital structure

Canadian content companies have very strange financials with very confusing balance sheets so let me clarify what the pro forma capital structure post sale of Untitled looks like:

$75M of cash available for use, and $0 of debt.

56.4M shares outstanding.

A tiny investment on BS for the 8.8% stake in TPG Entertainment.

That’s $1.33 of net cash per share.

Now if you pull the balance sheet you might start asking questions so let me clarify a couple things:

How come in Q1 24 the cash on the balance sheet was $98M and you’re saying cash is $75M after receiving the proceeds?

Cash and cash available for use aren’t the same thing. While cash in Q1 24 was $98M, cash available for use was only $36M. The difference between those two numbers is that a good chunk of BRMI’s cash on a given day is committed for certain projects. In order to be conservative the company discloses cash available for use as a true measure of excess cash. The $62M not counted as available in Q1 is essentially cash ear-marked for future production, so working capital.

Why do you say no debt when they have interim production financing of $107M?

I can do a long post on this alone but in Canada, the Federal government and the Provinces give very advantageous tax credits when production is done locally. This makes Canada a very favourable location to make content.

The thing is, because a lot of these grants and tax credits are not receivable on day 1 of production, but production companies need money to start projects, banks lend them through “interim production financing” which are backed by those grants and credits. It’s structured in a non-recourse way and is essentially working capital.

If you want to check there’s offsetting lines on the asset side under “production tax credits receivable”.

The investment thesis

Sale of Untitled Entertainment to TPG

On June 28th, before the open, Boat Rocker Media announced having sold their 51% stake in Untitled Entertainment for $51.8M CAD to TPG, which is going to use this acquisition as a platform to consolidate other talent representation agencies.

This brings the total “free” cash to $75M pro forma taxes and fees, or $1.33 of net cash per share, with a sale worth about $0.90 per share for a 51% stake in a business that isn’t their primary operations.

On top of that there’s a kicker in the 8.8% stake that BRMI retains in the new TPG entity. Based on the value of the whole transaction, it’s worth $8.8M, or $0.16 a share, but could grow into a nice amount if TPG does a good job growing it.

The new guidance for 2024 is now $10M of EBITDA. A big cut from $20M but primarily driven by representation going away since representation was a $10M EBITDA contributor in 2023, and with management likely expecting $15M for 2024 due to business coming back post actors/writers strike.

Depending on whether you trust management’s commentary on the Untitled sale call that this isn’t a guide down but just Untitled not contributing, or not and consider it a guide down. At least numbers to me are de-risked at $10M.

From the outside in it sounds great, you sold a non-core asset for more than your entire market cap, and realized significant value. But it’s actually better than that.

When BRMI acquired the 51% stake in 2019, there was a condition in the purchase agreement, a put/call provision that forced BRMI to either acquire the whole thing by June 2024, or find a way to dispose of the whole company.

BRMI does not have a great history of capital allocation, and the management team has kept talking about M&A as recently as the Q1 24 earnings call. After talking to IR, it seemed like the management team was in negotiations to acquire the remaining stake of Untitled which would have been catastrophic since it’d have been at a much higher multiple than their own and would have likely required leverage.

This sale removes a huge overhang on the stock, and I believe shows that Fairfax is getting more involved in preventing destruction of value, and pushing for the realization of value.

Trading below net cash with a very valuable RemainCo that’s under-earning

So BRMI today trades at a $1, has net cash of $1.33 per share. And RemainCo will generate $10M of EBITDA this year.

Current results are heavily affected by the SAG AFTRA strike where actors and writers went on strike grinding all developments to a halt and impacting in 2024 BRMI’s ability to deliver and sell shows.

If you look back in history, BRMI ex Representation used to generate between $15-23M of EBITDA per year. There’s no reason this can’t come back after we lap the effects of the strike.

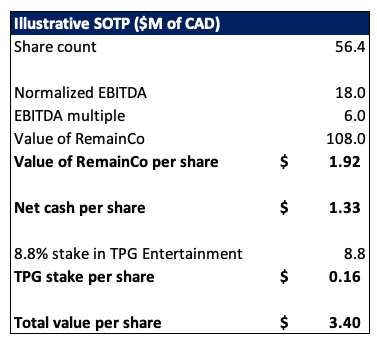

If we try to Sum of the Parts BRMI it looks like this:

Now we can debate on the multiple if we want to. This is just illustrative, pick your own multiple.

The environment has been very volatile for content multiples, 2020/2021 saw absurd multiples like 30x+ sales for HelloSunshine by Blackstone, large deals like MGM by Amazon for 27x EBITDA, but that’s not realistic anymore. Public peers trade at depressed multiples way below private markets, private markets are closer to 8-10x for ok IP. Wildbrain (WILD.TO) currently trades at 10x EBITDA, and Thunderbird Entertainment (TBRD.TO) trades around 5-6x EBITDA with a greater mix of service and less company owned IP.

The sale and Fairfax’s involvement greatly increases the chances of value being unlocked

So the stock is unbelievably cheap, but the management team has been mediocre at best when it comes to capital allocation and is talking about investing and doing M&A. How do we know the value isn’t going to be destroyed?

We won’t, but there’s things that re-assure me.

The big one is Fairfax. As I highlighted earlier, Fairfax is by far the largest shareholder and essentially controls the company through its multiple voting shares. I am sure most people are familiar with Fairfax but if you aren’t, they’re a very legitimate insurance company and very well known value investor who has a history of doing right by minority shareholders.

Well Fairfax internally knows that doing M&A is stupid, they have somebody on the board, and they’ve rode down this investment to oblivion. I am sure their first involvement in 2015 wasn’t cheap, and with another investment at the IPO around $9, they are probably pissed and want some of their money back.

I think that the sale of Untitled is the first step and was driven by Fairfax who probably helped bring TPG to the table as well.

I wouldn’t be surprised if internally, the management has a tighter and tighter leash on their investments, which would explain why they’re focusing on lower capital spend faster return projects like documentaries, and also explains the softening of tone about M&A, where now as of the latest call on Friday, management is talking about small deals, no studio, just cash-flowing content libraries from over-leveraged sellers. I think with Fairfax more on their back, the bar is now extremely high for a deal making it very unlikely.

I’d also invite everybody to look at Farmers Edge (FDGE CN), a company where Fairfax was the largest investor, essentially controlled the company. It became a microcap and was unprofitable (unlike BRMI) so hard to save, but they ended up acquiring it at the lows before bankruptcy at a 140% premium, and when minority shareholders voiced some discontent they bumped the bid even more to a 340% premium (which they didn’t need to do).

Risk(s)

Well to start off, let me start by saying that there are real risks, but with the stock trading at a 30%+ discount to cash on the balance sheet, with an EBITDA positive business left, that greatly de-risks lots of execution risk like “will they ever get back to $20-25M of EBITDA or is it more $15M”, or “what multiple is RemainCo worth given xyz”, I am not going to get into those because that’s just various ways to quantify just how much upside there is, not how much downside.

Management incinerates the cash with bad M&A

That’s truly the main risk. On the press release of the sale of Untitled and on the call with analysts post sale, management said that thanks to their very favorable balance sheet position, they’ll invest some cash in growing their IP with less capital intensive high return opportunity, but that they also will consider M&A.

“Boat Rocker may also use cash proceeds to pursue strategic M&A opportunities in a changing market” - Untitled sale press release

Here are the core reasons why I am not too worried about it

Fairfax’s involvement.

The Untitled sale showing a willingness to realize value (when they could have been forced to acquire the whole thing) and potentially more Fairfax involvement.

They haven’t bought anything in a long time.

The co-founders and the CEO together own 10.5M shares.

Less aggressive tone on M&A since the Untitled deal.

Let me expand on the last point. Go back to the Q4 2023 and Q1 2024 earnings calls, and the one doing M&A was a lot more aggressive, having talked to members of the executive team, their tone was also much more aggressive even hinted at buying out the rest of Untitled.

Then compare that to the call from June 28th, they’re still talking about M&A, but in a much more measured way, talking about potential IP opportunities from distressed over-leveraged sellers that would cashflow on day one and not buying large production companies.

What they’re describing is basically as buy vs build choice where you can buy almost finished or finished IP for cheaper than making it organically.

It’s also worth noting that if management tries to force a bad deal for the sake of doing a deal, somebody is getting fired.

Conclusion

In conclusion, I think $BRMI is one of the greatest risk/reward opportunities on the market today. I’ve greatly increased my position in the $0.90 range.

With $1.33 of cash on balance sheet, I think there’s tremendous downside protection, and the debate is all about how much upside. On that question I think $3-4 is definitely achievable, and could be accelerated or be even higher in the case of a take-out, or capital return to shareholders.

Friendly reminder that this is not investment advice, I am biased since I own shares in this company and I am not your financial advisor.

I posted the update on Twitter but I figured i'll do it here.

I got out of $BRMI.TO in the mid $0.90.

I don't think they've been buying back any shares despite announcing it, just given volumes, stock trading and the fact that they haven't filed.

But in all honesty, nothing's wrong with it, it's extremely cheap and likely to get taken out by either Fairfax or someone else. I just have too many opportunities with concrete catalysts I decided to invest into, and $BRMI.TO despite having significant value, is an uncertain timeline to realizing it.

Thanks for the writeup! I got a bit confused about how the accounting of its production segment works, maybe you could help me to better understand it?

Let's say BRMI signs a presale contract with Netflix today that Netflix will pay $XXX upon the delivery. Say BRMI finishes the production and delivers at the end of year N from today. Here is my understanding of how the accounting works for this contract: no revenue from this contract is recognized during this N years and all amount of XXX is recognized as revenue at the end of year N. In the mean time, all the costs incurred from the production are added to the Investment on Production entry on its balance sheet and is amortized during this N years. So at the end (ignoring other business) BRMI will have operating loss for N-1 years and then some profit at the end of year N.

Is my understanding correct? Thanks!